unlevered free cash flow vs levered

Enterprise value is a measure of the companys. Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another.

Discounted Cash Flow Analysis Street Of Walls

At 1244 the levered IRR is higher even though the annual cash flows are lower.

. Free cash flow provides a firm an indication of the amount of money a business has left for distribution among shareholders and bondholders. Levered Free Cash Flow. There are two forms of free cash flow.

Whereas levered free cash flows can provide an accurate look at a companys financial health and the amount of cash it has available unlevered cash flows provide a look at the enterprise value of the company. Plus to make a comparison between companies UFCF is more favored. On the other hand Unlevered Free Cash Flow provides a more attractive number of free cash flow than Free Cash Flow and Levered Free Cash Flow since it excluded interest payments.

Unlevered free cash flow or just FCF is different from levered free cash flow because unlevered free cash flow does not account for debt principal payments. Levered free cash flow on the other hand works in favor of the business that didnt borrow any capital and doesnt necessarily show a comparative analysis of each companys ability to generate cash flow on an ongoing basis. Unlevered and levered cash flow will appear on your balance sheet as separate items.

It represents the cash available to grow a companys revenue-generating capacity using all sources of funds. If you remember one rule of thumb regarding cash flows it should be this. This gives us a sense of how the companys cash flow profile develops over time.

Free cash flow is the amount of money left over when all outflow is subtracted. The difference between UFCF and LFCF is what financial costs they account for. Unlevered free cash flow is known as free cash flow to firm.

If the company has minimal debt maybe an unlevered free cash flow is sufficient. Levered cash flow is the amount of cash a business has after it has met its financial obligations. Excludes interest expense and ALL debt issuances and repayments.

Unlevered cash flow is the cash produced by a property before any loan payments are made. If the company is heavily indebted it likely has a lot of interest expense in which case a levered free cash flow likely gives a better picture of the cash that a company generated after all expenses are incurred. Proper financial management for small businesses will put you in a better position to secure loans and grow your company.

Each is critical especially to potential partners investors or anyone interested in buying your company. Thus positive UFCF is the cash generated and. When would you use levered cash.

Unlevered Free Cash Flow. Keep in mind that for business accounting purposes the broad term for expenses can include more than operating expenses. With the above definitions in mind unlevered free cash flow does not include expenses while levered free cash flow factors them in.

Includes interest expense but NOT debt issuances or repayments. Difference Between Levered And Unlevered Free Cash Flow. They all treat interest expense and debt repayment differently.

Unlevered free cash flow also known as UFCF is the freely available cash to all categories of capital providers. Unlevered free cash flow UFCF is the cash flow available to owners of all sources of capital equity-holders mezzanine financing owners and debtholders. Free cash flow is generally calculated by adding cash flows from operating activities to cash flows from investing activities.

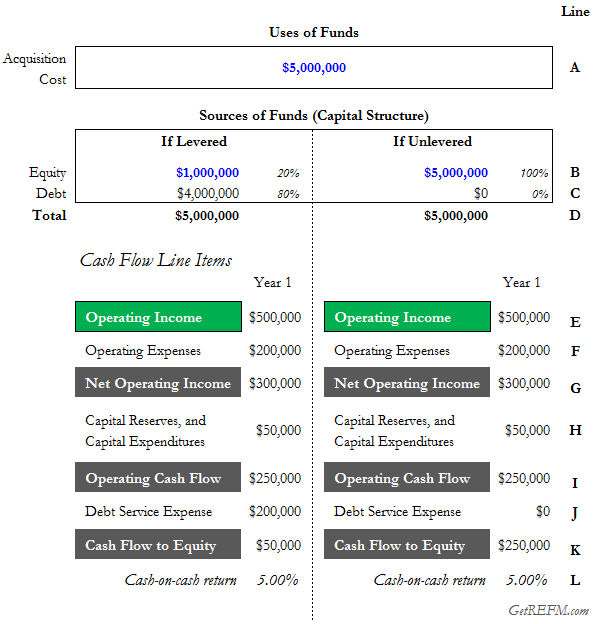

To better track your finances youll want to make sure you use trusted accounting. Includes interest expense and mandatory debt repayments but opinions. In addition the average cash-on-cash return of 2360 is higher due to the financial leverage placed on the property.

Free Cash Flow to Equity While unlevered free cash flow looks at the funds that are available to all investors levered free cash flow looks for the cash flow that is available to just equity investors. Interest debt payments are part of the free cash flow formula calculation as interest expense. Levered vs Unlevered Free Cash Flow.

Like levered cash flows you can find unlevered cash flows on the balance sheet. Final Thoughts The key point here is this. It is also thought of as cash flow after a firm has met its financial obligations.

Free cash flow indicates gross cash flow rather than net. FCFF EBIT - Taxes Depreciation Amortization - Change in Working Capital - Capital Expenditure. Unlevered free cash flow is the money the business has before paying its financial obligations.

What Is Free Cash Flow Calculation Formula Example

Discounted Cash Flow Analysis Street Of Walls

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Ufcf Lumovest

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

What Is Levered Free Cash Flow Definition Meaning Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Understanding Levered Vs Unlevered Free Cash Flow

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Big Sale Off 79

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

Fcf Yield Unlevered Vs Levered Formula And Calculator